Heirs can use a small estate affidavit to transfer property without a formal probate only in situations when:

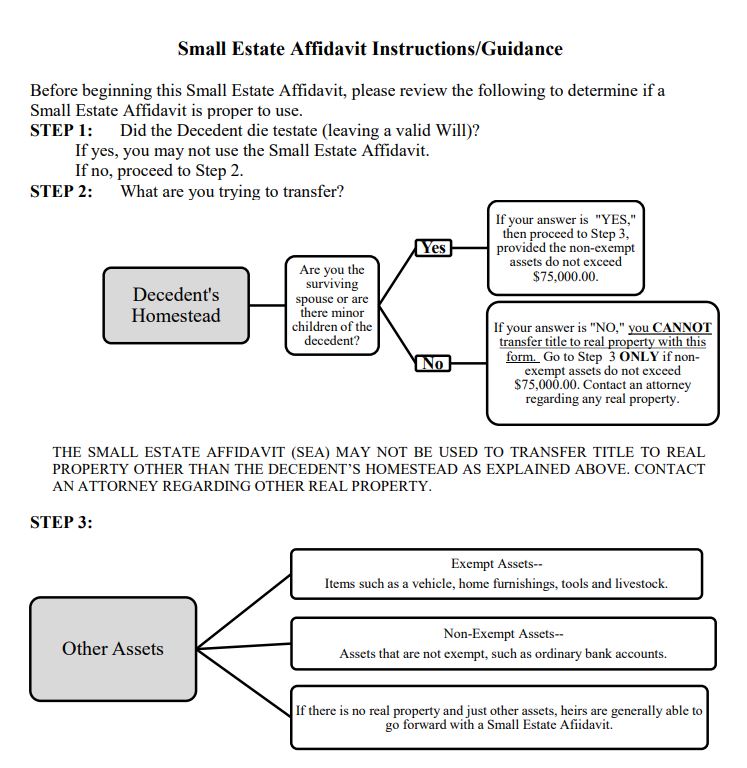

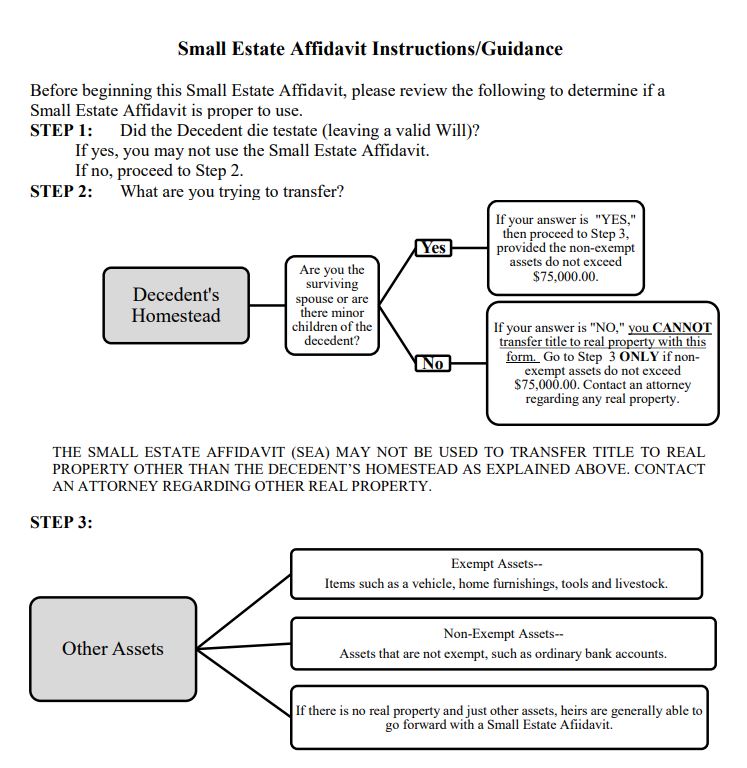

The Harris County Clerk’s office created a useful flowchart to help Texans determine whether a small estate affidavit is proper:

It is only possible to transfer real estate using a small estate affidavit if the property was the decedent’s homestead and the decedent is heirs are a spouse or minor children.

If the property was not a homestead and the heirs are not a spouse or minor children, it is not possible to use a small estate affidavit to transfer real estate.

According to Section 42.001 of the Texas Property Code, exempt assets for a married decedent include a homestead for the use and benefit of a surviving spouse or minor children and up to $100,000 worth of personal property that will be used for the benefit of a surviving spouse, minor children, unmarried children who were living in the decedent’s home, and incapacitated adult children.

If the decedent was single, personal property worth up to $50,000 is considered exempt property.

Section 42.002 lists the following examples of exempt personal property: E

Pension benefits, retirement assets and insurance benefits are also exempt.

Note that the $75,000 limit pertains only to the value of a decedent’s probate estate, not the gross estate. The probate estate consists of property titled in the decedent’s name, excluding value of the homestead. It does not include assets placed in trust. It also does not include assets that transfer by payable-on-death accounts, transfer on death designation, or beneficiary designation.

So suppose a decedent had a $500,000 life insurance policy and a $300,000 retirement plan. If he named has wife has the beneficiary, and the value of his remaining assets, excluding his homestead, do not exceed $75,000, his estate might still qualify for small estate administration.

It is not necessary to hire a lawyer to file a small estate affidavit. In fact, many probate courts provide forms on their website for the public’s use. For example, Harris County provides a very good small estate affidavit form (pdf), as well as detailed instructions for filling it out.

Once the affidavit is complete, you should file the affidavit with the probate court. The Court will review the affidavit to confirm that it complies with the statutory requirements. If the Court approves the affidavit, the heirs can use a certified copy of the affidavit of the estate to collect money the estate is owed or assets the estate owns.

This article was originally published on March 3, 2017, and updated on August 9, 2023.

Rania graduated magna cum laude from South Texas College of Law Houston and is the founder of Rania Combs Law, PLLC. She has been licensed to practice law since 1994 and enjoys helping clients in Texas and North Carolina create estate plans that give them peace of mind.